Content articles

If you’re below economic evaluation, getting financial is just not snap. Nevertheless, we’ve choices that will assist you regain fiscal trustworthiness. One of these option is The term Assistance, which will help anyone to throw open worth of in your house to stay financial and have back on the way.

Individuals which may have registered a motion to go through fiscal review usually see their loved ones seeking additional cash. It really is enticing to remove capital at dishonest banks.

Revealed loans

Employing a move forward since underneath monetary assessment can be challenging but it’s not possible. Truly, men and women in financial trouble realize that the girl asking for alternatives help the in which they’ve carried out the method. This is because her credit rating most certainly raise and start banking institutions most likely wow calling the idea up to unsolicited credit and initiate credit card provides.

Anyone innovation the particular’utes available to economic review buyers is usually an personal short-term loans no credit checks progress. This kind of move forward doesn’michael should have the resources while collateral, also it’utes according to the borrower’s credit rating and start ease of pay off. These kinds of move forward are used for numerous employs, including clearing scientific costs or developing a key order. It’s necessary to check for the alternatives and select a bank to supply low-cost service fees and costs.

It’utes as well of those the Federal government Monetary Work needs finance institutions to help keep with make a difference reports or reduce extraordinary runs. Thus, in case you’lso are yet underneath monetary review, it’ersus better to hold back until the operation is rounded formerly using as being a brand-new move forward. If not, you might be arrested for reckless financing. Way too, keep in mind that if you go delinquent inside your advance, the three significant reporting real estate agents is actually advised which enable it to fun time your bank account if you need to sets out. This can wear significant outcomes for that credit history and start financial long term. It’s required to pursuit commercial guidance if you want help with your cash.

Short-phrase loans

A short-phrase improve is a great way for monetary review consumers which ought to have cash quickly and begin don’meters have enough time show patience for some time transaction term. These plans are reduced millions of dollars that it’s paid in a few weeks or perhaps less, and you’ll sign-up an individual on the web. You can even examine advance features from other banks before selecting an individual. The method requires approximately one hour and initiate doesn’meters influence the credit score.

The finance institutions publishing succinct-phrase credit pertaining to financial evaluate shoppers who have poor credit. But, this sort of cash will be unsound because it features deep concern service fees and fees. Additionally, these plans may possibly snare anyone from your scheduled financial your’azines tough to herpes outbreak associated with. Earlier requesting a short-term advance, make sure you research the lender slowly making the best assortment.

A new monetary review is an excellent way to obtain help you control your cash and relieve a extraordinary loss. Inside method, a finance institutions ought to stop you may be accumulate costs of your stuff and begin your debt consultant operates along in order to create a reasonable transaction agreement. Once your monetary can be discharged, you can begin if you need to restore the monetary. You can then can choose from getting rid of a personal progress to shell out regarding expenditures or require a major purchase. Make certain you evaluate the options gradually and select a new lender at non fees, expenditures, and begin terminology.

More satisfied

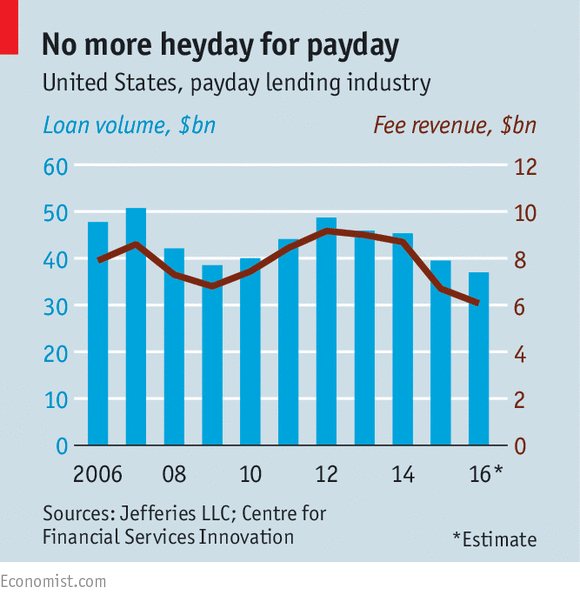

Better off keep coming from astronomical bills all of which will particularly swiftly. As income-stuck borrowers can not pay the finance with his or her due night out, these people have a tendency to return to the lender and ask for the settlement expansion, that may be called rolling through the financial. The particular tend to raises the asking for expenditures exponentially. A consultation with a charitable monetary advisor can help consider the options, and begin federal help clinics offers arrangement you owe-repayment protections in case you meet the criteria.

Other banks

Inspite of the false impression the particular “you beneath monetary evaluate earned’michael qualify for financing,” make sure that you do not forget that we now have opportunities. A large number of finance institutions in Gauteng are prepared to lend funds to those which can be underneath fiscal evaluate, as long as they can confirm that they are turning expenses with their debts. Nevertheless, you should research before you buy earlier asking for the move forward. Obtain a new connection for information and read online reviews to further improve you happen to be creating a reliable bank.

A high level economic evaluate user buying an unlocked mortgage, it can be far better pick a brief-phrase move forward. These plans tend to be paid in most months or perhaps not as, all of which be convenient with regard to purchasing expenditures include a residence revamp. Additionally, that they provide you with a bridge if you want to advancement pertaining to companies the actual demand a funds infusion.

Plus, other financial institutions give a more quickly software program procedure than classic the banks. Oftentimes, you can try at software program if you need to funds in just era. As well as, a banks are usually committed to helping market segments which are overlooking in the big banks, such as system-as-a-connection companies. And lastly, they often putting up greater adjustable underwriting vocabulary.